If you’re making online payments to or from Nigeria, the chances are that a local startup, Paystack is helping you spend your money.

Africa has long has been perceived as one of technology’s final frontiers.

Few have felt that perception worse than businesses and professionals who have had to use more traditional methods to make and receive international payments.

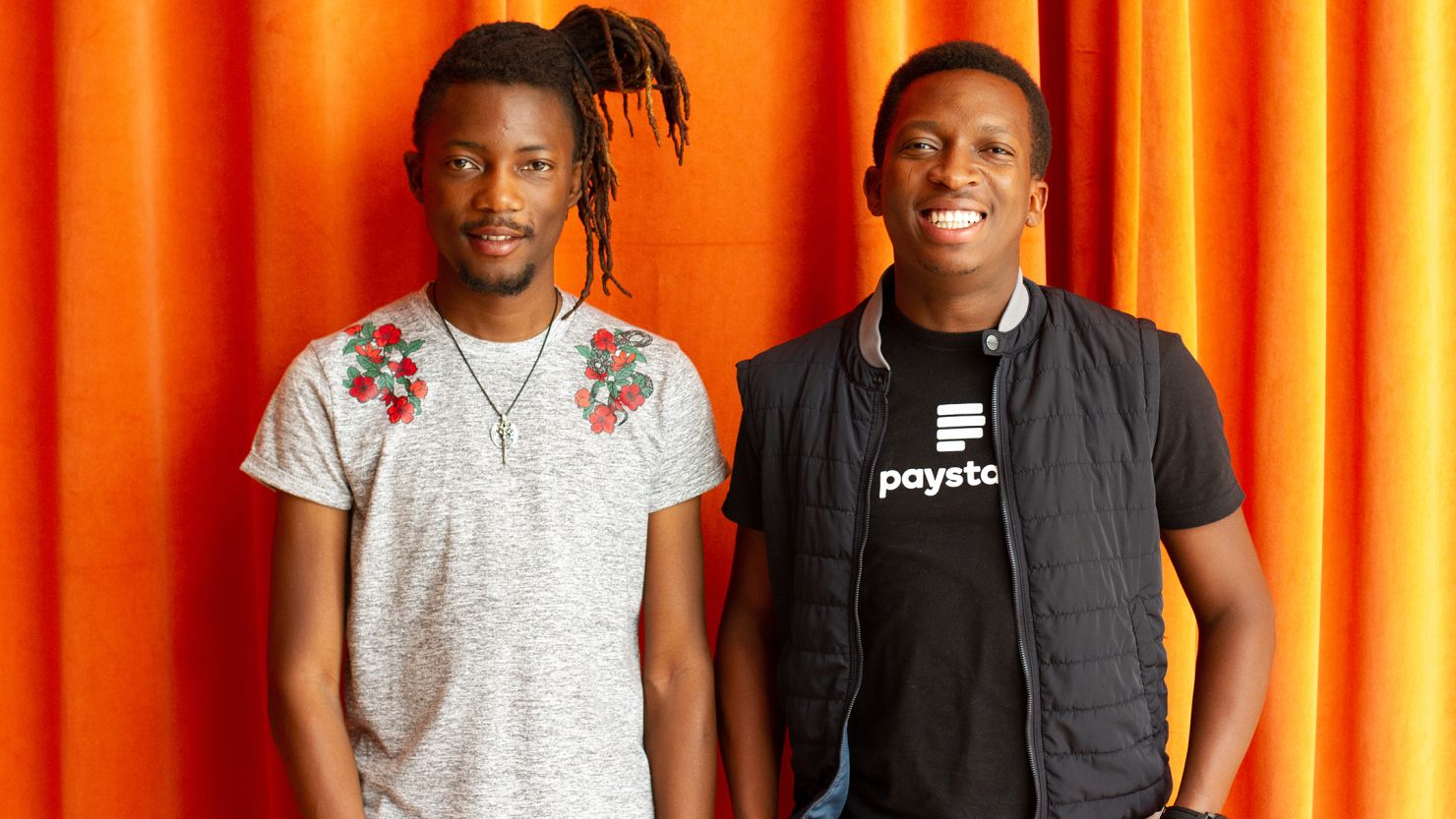

In January 2016, two young techies, Shola Akinlade and Ezra Olubi came together to solve that problem by launching Paystack, a payments processing company.

Just over two years in, the young startup, with headquarters in Lagos, Nigeria, could become Africa’s response to Paypal and Stripe.

Bridging the gap

When Olubi and Akinlade first approached the idea for Paystack, receiving foreign payments in Nigeria was challenging.

“It would take a minimum of 3 weeks for a business to start accepting payments online, from filling paper forms to making up-front payments to going through a complex integration process,” Shola Akinlade, the company’s CEO told CNN.

The African tech hubs fostering innovation

Paystack’s attempt to solve that problem was to provide a website link for secure online payments.

“We took it a step further, realizing that most businesses don’t have access to developers and built a simple tool that allows a business [to] create a payment link they can add on their website or share with their customers on social without needing a developer.”

Now, according to the startup’s CEO, “businesses can start accepting payments in less than 30 mins.”

Follow CNN Africa on social media

“We started Paystack because we believe that better payment tools are one of the most important things that African businesses need to unlock their explosive potential,” Akinlade says.

That aim has helped the company raise over $10 million dollars in funding over the last two years.

Paystack says it now processes nearly 15% of all online payments in Africa’s largest economy - Nigeria, with $20 million in transactions paid out to merchants in August 2018.

Investment potential

That same month, Paystack announced that it raised $8 million in a round of funding led by Stripe - another payments processing company which processed more than half of all American transactions in 2017.

The investment underscores a trend that has seen global technology companies investing into the startup ecosystems in Nigeria and Ghana.

“The Paystack founders are highly technical, fanatically customer oriented, and unrelentingly impatient,” said Patrick Collison, CEO of Stripe, in a statement. “We’re excited to back such people in one of the world’s fastest-growing regions.”

Africa’s immense population holds a huge potential for payment platforms. But according to the World Bank, half of Sub-Saharan Africa’s population do not use official financial services.

Providing financial services for people without a bank account is Paystack’s next aim.

“We’re investing heavily in making available all types of local and regional payment channels beyond card payments to ensure that customers can pay however they feel most comfortable,” Akinlade says.

Some of its biggest investors are certain that by exploring offline payment systems like QR codes, Paystack can bring the rest of Africa into global online trade.

“Our investment in Paystack aligns with the kind of investments we look for – those that will help extend our reach into the global commerce ecosystem as it changes and grows, and that will provide mutually beneficial business opportunities,” said Otto Williams, head for strategic partnerships, fintechs and ventures for Visa in Central & Eastern Europe, Middle East and Africa (CEMEA), in a statement.

Paystack says it’s looking forward to launching in numerous African countries soon.